5 min read

Most high school students graduate knowing that the mitochondria is the powerhouse of the cell, yet aren’t aware of the difference between stocks and bonds.

Students are taught how to find the hypotenuse of a triangle, yet have no idea how to do their taxes.

They memorize the periodic table of elements, yet have no clue how to track their income and spending.

The sad truth about our current education system is that personal finance is not a required course in most high schools, which means most students graduate and enter the real world without a lick of financial knowledge.

The good news is that the internet has made it easier than ever to learn about personal finance without taking a formal course. In particular, reading a few good personal finance articles each day can be a painless, easy way to acquire the financial knowledge that schools fail to teach.

In this post, I share some important money lessons that I wish I learned in school.

How to Make Money With Your Laptop

Most young people believe that the only viable way to earn a living is through getting a college degree and landing a traditional 9-5 job. However, the internet has made it possible for virtually anyone to become a freelancer or an entrepreneur and earn money from their laptop.

This eliminates the need for a daily commute, a strict work schedule, adherence to a dress code, and all of the other annoying factors that come with traditional jobs.

Through trial and error over the past three years, I figured out how to earn a living purely through owning a small portfolio of websites, which allowed me to quit my day job as a data scientist. Now I earn a living from my laptop and I’ve never been happier or had more freedom.

Why Owning Assets Leads to Wealth

“The purpose of having money is so that you don’t have to be at a specific place at a specific time doing anything you don’t want to do.” -Naval Ravikant

To be “wealthy” is to own your time. The wealthiest people in the world are the ones who get to wake up each morning and get to decide exactly how they’d like to spend their day.

The way to gain this freedom over your time is to own assets that earn money for you while you sleep so that you don’t have to report to a job to earn money.

An asset is anything that tends to increase in value over time or pays you money simply for owning it. Some examples are real estate, stocks, bonds, websites, and businesses.

You can buy and/or build these assets. For example, you could use your paycheck to buy stock index funds. Or you could dedicate your time to building a website that earns income for you while you sleep through using SEO.

And once you acquire enough assets that earn money for you, you no longer need a day job to pay the bills. That’s wealth.

The Importance of Tracking Your Finances

One of the most important rules of personal finance is to track your finances. In particular, you should know:

- How much you earn each month.

- How much you spend each month.

- Your monthly balance in each of your financial accounts.

- How much you’re paying in investment fees.

Personally I use Mint to track my monthly cash flow and Personal Capital to track my investments. Both tools are free.

The Concept of Compound Interest

Compound interest is one of the most important concepts to understand in personal finance, yet it’s hard for most people to wrap their head around because it’s so counter-intuitive. For this reason, I like to show people visualizations to illustrate how it works.

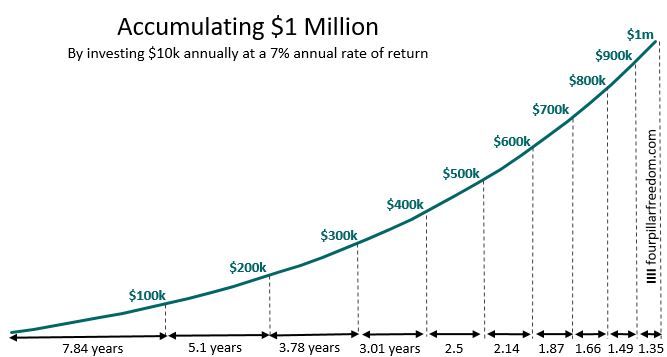

The following chart shows how long it takes to reach various $100k net worth milestones, assuming you invest $10,000 each year at a 7% annual rate of return:

Notice how it takes less time to go from $700k to $1 million than it does to go from $0 to $100k. This is the nature of compound interest: it is annoyingly slow in the early years and shockingly fast in later years.

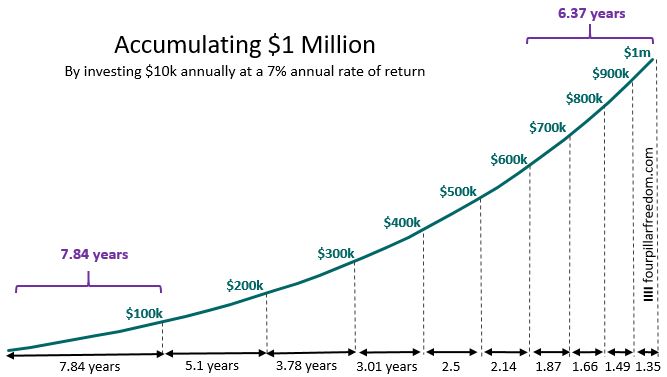

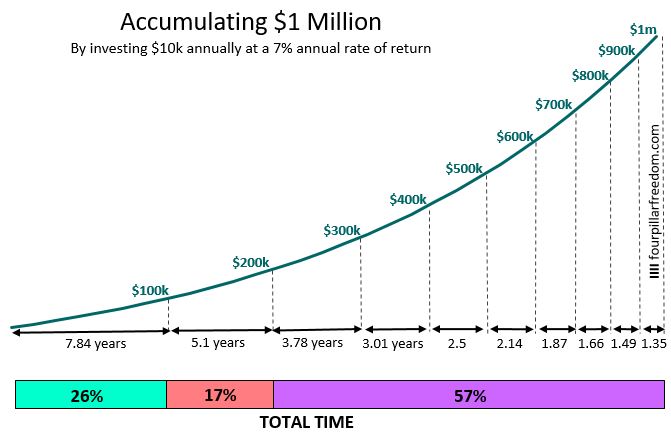

Here’s another way to view the same chart: On the road to accumulating $1 million, 26% of the entire journey is spent going from $0 to $100k while another 17% of the journey is spent going from $100k to $200k:

Understanding this concept is especially important for young investors who feel like the journey is agonizingly slow in the beginning. The key is to know ahead of time that building wealth is slow-going at first. This prevents you from getting discouraged early in your journey.

Why Income Matters More Than Investment Returns Early on

Many young people think that the “sexy” way to build wealth early on is to pick the next unicorn stock. Unfortunately, picking individual stocks is hard and most young people don’t have enough money to invest to make lucky stock picks worthwhile.

For example, investing $1,000 into an individual stock that doubles in price in under a year would be an excellent investment, but would result in less than a $1,000 gain after trading fees and capital gains taxes.

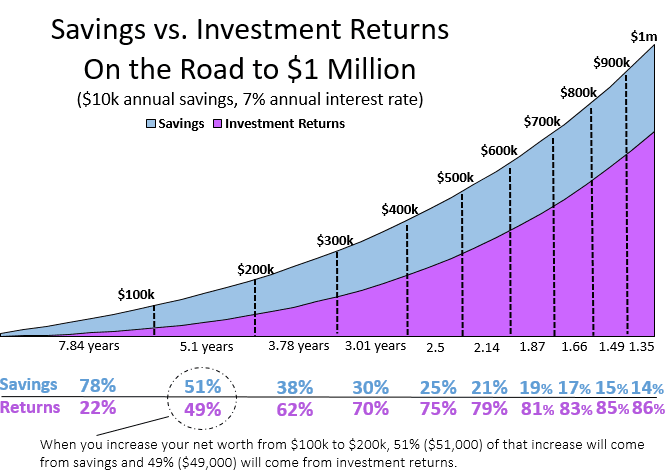

The real way to build wealth early on is to focus on generating a high income and thus a high savings rate. Check out the following chart that shows just how much savings vs. investment returns matter on the road to accumulating $1 million:

Notice how savings account for much more growth early on than investment returns.

It’s a good idea to start investing as young as possible, but just be aware that the amount you save matters more, at least in the beginning.

Focus on becoming an income machine, not an investment guru.

Related: One of the easiest ways to increase your income through flipping items for profit.

Don’t Be Scared of Market Crashes

One of the most common mistakes average investors make is thinking they need to time the stock market. After all, if you can buy and sell at just the right times, you can increase your investment returns.

The bad news is that it’s incredibly difficult to predict how the stock market will perform on a short-term basis and attempting to buy and sell at the right times usually leads to lower returns.

A better strategy is to recognize that market crashes don’t last forever and that the stock market tends to increase significantly over time. By arming yourself with this knowledge, you increase the probability that you stick with your desired asset allocation through the ups and downs of the market.

As a rule of thumb:

Stocks are high-growth and have high volatility.

Bonds are low-growth and have low volatility.

This means that if you invest in stocks, your investment will probably take a bumpy, high-growth ride to higher prices. Conversely, if you invest in bonds, your investment will probably take a smooth, low-growth ride to higher prices.

The amount you invest in stocks compared to bonds is known as your asset allocation. And this allocation should be determined by when you need to sell your assets and cash out. So, when the market does crash you don’t have to be reactive.

If you’re someone who doesn’t plan on selling your stocks for several decades, a market drop is an opportunity to pick up more shares at cheaper prices. After all, you shouldn’t care about how much you can get if you sell now. You should care about how much you can get several decades from now when you actually need to sell.

And if you’re someone who needs to sell your stocks in the next few years to fund your lifestyle, hopefully your asset allocation isn’t heavily tilted towards stocks. This way, when the market drops you don’t have to panic.

How to Become Money Savvy

Most schools don’t teach personal finance, but you don’t need to take a formal class to learn about money anyway. Everything you could ever want to learn is online.

If you want to become money savvy, here are a few resources that you might find helpful:

Blogs – Reading personal finance articles is an easy way to increase your financial knowledge a little bit each day. If you’re overwhelmed by the sheer amount of personal finance blogs out there, I recommend using Collecting Wisdom, a site I created that shares a constantly updated feed of articles from the best finance blogs on the internet.

Books – Reading personal finance books is an obvious way to increase your financial knowledge. If you’re simply looking for book summaries of some popular finance books, check out my book summaries page.

Podcasts – Listening to podcasts is another easy way to absorb financial knowledge. A couple of my favorites are The Afford Anything Podcast and The Mad Fientist Podcast.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.