3 min read

In statistics, we use a “distribution” to describe the behavior of a variable. For example, the height of humans follows a normal distribution.

The variable here is height. The average height of a female adult in North America is 65 inches. 95% of female adults are between 58 and 72 inches tall. This means only 5% are taller than 72 inches or shorter than 58 inches.

This is the nature of the normal distribution. The bulk of people have a height close to the average, while very few have a height significantly taller or shorter than the average.

The normal distribution is the most well known in statistics. It’s known for it’s “bell-shape”. A lesser, often more useful distribution is the power law distribution, which is shaped much differently.

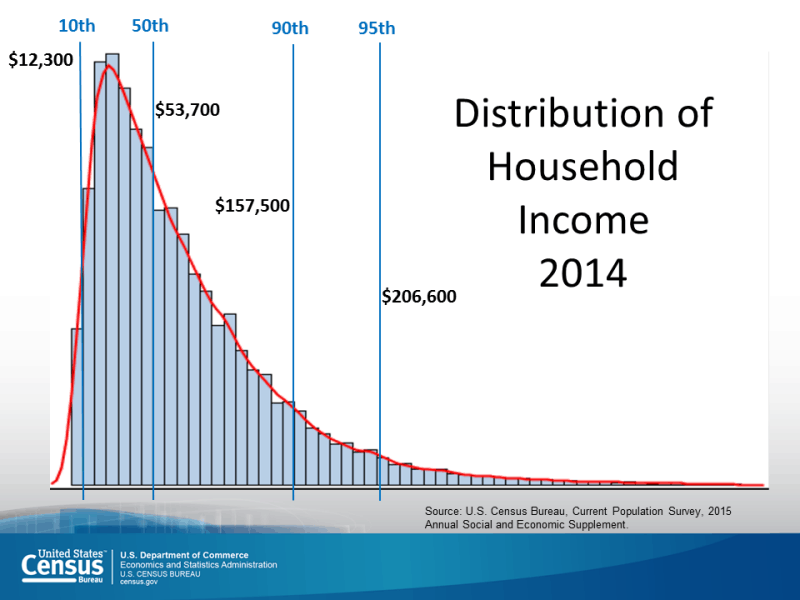

It also describes the behavior of many natural phenomena, including income distribution.

The variable here is income. Notice how 50% of all households earn an income between $0 and $53,700. As income extends higher as you move to the right, fewer and fewer families meet those income requirements. For example, only 5% of all households earn more than $206,600 per year.

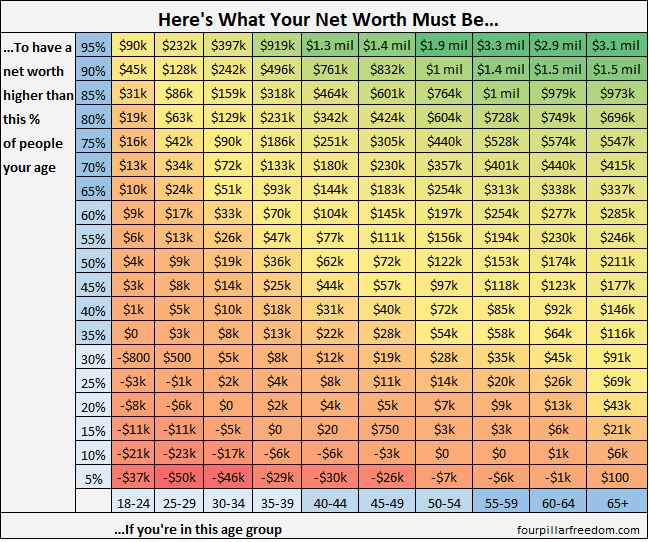

Net worth also follows a power law distribution. In an earlier post, I shared the net worth percentiles for individuals in the U.S.

Check out the 30 – 34 year-old group. Half of the individuals in this age group have a net worth less than $19,000. As you move that net worth marker higher and higher, fewer individuals meet the criteria. For example, only 5% have a net worth higher than $397k.

Net Worth Ramps Up Faster Over Time

Notice in the above chart, the net worth of the 90th percentile is at least 10 times higher than the net worth of the 50th percentile in nearly every age group. This means the people in the 90% have considerably more financial flexibility than those in the 50%.

But it gets even more absurd. The net worth of the 95th percentile is about twice as much as the net worth of the 90th percentile in each age group. This illustrates the nature of a power law distribution: To go from being a member of the 50% to the 90% requires some dedicated savings and hard work, but to then go from 90% to 95% requires you to double your net worth.

At first glance, these numbers seem a bit discouraging. To go from the 50th to the 90th percentile means you need to increase your net worth tenfold. This sounds daunting until you understand the math behind compound interest and the power of consistent yearly savings increases.

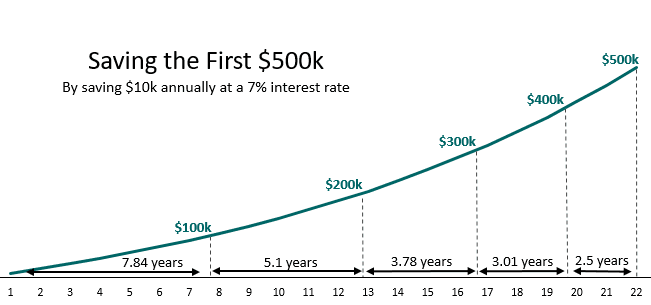

I shared an example last week of how someone can save $500k by investing $10k at a 7% annual interest rate. Each $100k takes less and less time to save thanks to compound interest:

This illustrates how net worth increases faster and faster over time thanks to compound interest.

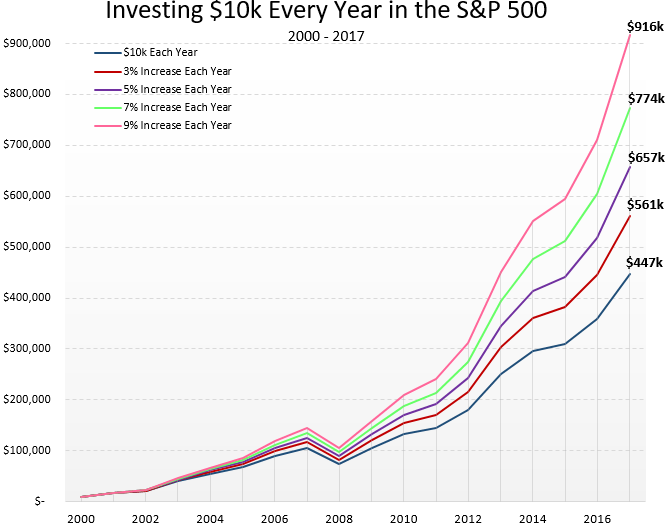

I also shared in a different post the power of increasing how much you save each year.

Someone who saved $10k each year from 2000 – 2017 would have ended up with $447k, compared with the $916k someone who increased savings each year by 9% would have saved:

These two powerful forces are what allow ordinary people to enter the 90th percentile in net worth.

In the beginning, it will be slow. Paying off debt, working your way up the income ladder, and stacking up savings will take time. But if you stick with a consistent savings plan and increase how much you save each year, you can become part of the 90th net worth percentile for your age group sooner than you think.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Such interesting information. We are one of the wealthiest nations in history but so few Americans actually generate the net worth they could if they just moderated their spending and began investing as soon as they started earning money.

Just found your blog. All the graphics and info is awesome. How do you find time to blog every single day?!

Thanks, Olivia! I usually am able to churn out a post in 2-3 hours before I go to work each morning. It helps that I have a daily writing habit – I wrote a little bit about it here https://fourpillarfreedom.com/the-art-of-schedule-shifting-how-i-find-time-to-blog/

Thanks for the kind words 🙂

More great content here Zach, loving it!

Thanks, Mr. Mofi!