6 min read

Here are nine pieces of advice for anyone looking to save and invest in their 20s.

1. When you’re just starting out, focus on growing your income.

As an early 20-something, you likely don’t have a significant amount of savings to invest. Even if you do have $10,000 saved up through working retail jobs and flipping items on Ebay, this isn’t enough capital to make you wealthy anytime soon.

For example, if you invest $10,000 into a stock index fund and earn a 5% return in a given year, that’s only $500. Or even if you invest $1,000 in an individual stock that doubles in price in 12 months, that’s only a $1,000 profit before trading fees and taxes.

You’re better off developing a skill set and/or earning a degree that you can use to earn a high income.

I personally received a Master’s degree in statistics, which is what enabled me to land a salary of $80,000 by age 23. This degree alone helped me boost my income more than any investment returns could in my early 20s.

You don’t need a graduate degree to make decent money, though. There are plenty of jobs that pay more than $50k per year that require less than a bachelor’s degree. To name a few:

- To be an air traffic controller you need an associate degree and the median salary is $124k

- To be a transportation, storage, and distribution manager you need a high school diploma and the median salary is $92k

- To be a radiation therapist you need an associate degree and the median salary is $80k

Another skill in high demand is programming. I’m biased because I am around programmers constantly in my day job as a data scientist, but I can attest that the supply of people in the U.S. who know how to write code does not meet the demand of companies who need people to do so. If you can learn a programming language, you can dramatically increase your chances of landing a high starting salary in your 20s.

Related: My Firsthand Experience Learning a Programming Language for My Day Job

2. Follow the opportunity, not your passion (at least not initially)

As a 20-something, you simply haven’t had enough time or experience to know where your skills are, what type of work you enjoy doing, or what type of environment you thrive in. For this reason, it’s best to follow opportunity. Just get started working somewhere. It doesn’t have to be your dream job. Focus on earning some money and finding out what type of work you enjoy doing.

From the book Tribe of Mentors by Tim Ferriss, the founder of Wired Magazine Kevin Kelly gives the following advice to young people about to graduate college:

“Don’t try to find your passion. Instead master some skill, interest, or knowledge that others find valuable. It almost doesn’t matter what it is at the start. You don’t have to love it, you just have to be the best at it. Once your master it, you’ll be rewarded with new opportunities that will allow you to move away from tasks you dislike and toward those that you enjoy. If you continue to optimize your mastery, you’ll eventually arrive at your passion.”

Chris Anderson, the CEO of 3D Robotics, gives similar advice to young people:

“Many of us have bought into the cliché ‘pursue your passion.’ For many, that is terrible advice. In your 20s, you may not really know what your best skills and opportunities are. It’s much better to pursue learning, personal discipline, and growth. And to seek out connections with people across the planet. For a while, it’s just fine to follow and support someone else’s dream. In so doing, you will be building valuable relationships, valuable knowledge. And at some point your passion will come and whisper in your ear, ‘I’m ready.'”

This advice is practical. You don’t have to love your first job out of college. You just need to use it to build your skills and lay the bricks of a your financial foundation.

This is exactly what I did with my first job. I saved close to 80% of my $52k salary and learned voraciously on the job. When I asked for a promotion and got denied, I simply used the skills I had learned to land a position at a new company that paid me $80k per year.

Related: Should You Follow Your Passion or Follow the Money in Your 20s?

3. Once you do start making some serious money, resist the temptation to blow it on lifestyle upgrades.

I don’t know many people under 25 making $100k+ per year. Of the few that I do, every one of them bought a brand new car and/or house when they landed their job. In essence, they cancelled out their high income with nearly equally high expenses.

I’d recommend doing the opposite. When you do start making good money, buy assets, not liabilities. Buy stocks, real estate, websites, ownership in businesses, or anything that tends to pay you over time. Don’t waste your money on things that require payments from you.

In general, upgrading your lifestyle in your 20s is pointless. This tweet sums up my thoughts:

In addition, if your motivation to upgrade your lifestyle is to impress your peers, this likely won’t have the intended effect due to the “Rich Man in the Car Paradox.”

When you see a rich man in a car, you don’t think about how cool he is. Instead, you think about how cool it would be if you personally owned that car and the attention that would come from it.

This phenomenon extends to most material purchases. When you buy new shoes, a watch, a car, or a house, your peers will think about how sweet it would be if they themselves had those things. They won’t obsess over how impressed they are with you.

Better to be humble, save your money, and quietly grow your net worth.

Related: Buy less stuff. Buy more assets.

4. Outside of your day job, become a voracious learner.

Listen to podcasts and read blogs/books by people who are further along the financial path than yourself.

A few of my favorite books can be found on my recommendations page.

A few of my favorite podcasts include:

As you grow your tree of knowledge, apply what you learn. Some examples of how I have done so in my own life:

Once I discovered the math that explains why index funds are so hard to beat, I stopped trading individual stocks and instead invested in stock market index funds.

Once I read The Slight Edge and discovered the effectiveness of daily habits, I began to develop my own daily writing habit. This has lead to a blogging income stream for me, which brought in $1,044 last month alone.

5. Aim to minimize the “big three” expenses of housing, transportation, and food.

I personally keep these three expenses fairly low through:

- Sharing an apartment with a roommate ($611 monthly rent)

- Driving a Honda Civic (cheap, reliable, good gas mileage)

- Cooking 75% of my meals at home

If you’re able to land a decent income in your 20s and can get a grip on these “big three” expenses, you can’t help but save a decent chunk of money each month.

6. As a rule of thumb, spending on experiences will make you happier than spending on material possessions.

In your 20s, the way to get the most out of your spending is to focus on acquiring experiences, not material possessions.

As I outlined in this post, there are seven reasons why experiences lead to more happiness than possessions:

- A possession is a potential pleasure, but an experience is an active enjoyment.

- Possessions are predictable, but experiences are full of surprises.

- Possessions break, but memories keep getting better over time.

- Possessions cost money, but many experiences are free (As Mr. Money Mustache once said, “Nature-based leisure activities often come with a very low price tag, especially when done close to home.”)

- Possessions do not satisfy our deepest needs, but the right experiences do.

- Products invite comparisons, but experiences stand apart.

- We are the sum of our experiences, not our possessions.

I can personally testify that two of my favorite memories from college were the study abroad trips I took to Costa Rica and Japan, two incredible experiences that I’ll likely always remember. These two trips alone brought more joy than any watch, pair of shoes, or new clothing I ever bought.

7. Invest in broad market index funds early and often.

Although investment returns won’t impact your net worth much early on, it’s still a good idea to invest early and often. I recommend broad market index funds, which hold hundreds or sometimes thousands of individual stocks.

For an explanation of why index funds tend to perform so well over time, check out these three posts:

The Bogleheads’ Guide to the Three-Fund Portfolio

Why It’s So Hard To Outperform Index Funds

A Recap of Warren Buffett’s 10 Year Bet on the S&P 500

8. Your Savings Rate is the Number One Metric that Determines When You’ll Be Financially Independent.

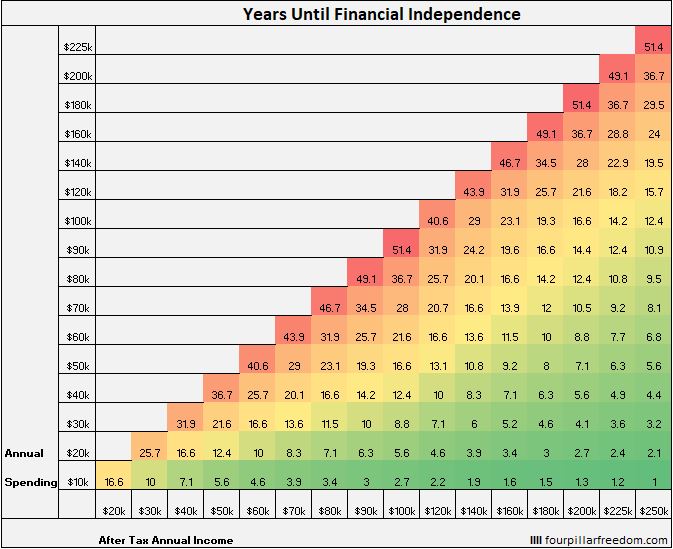

“Financial independence” is typically defined as having 25 times your annual expenses saved up. This grid shows how many years it will take to achieve F.I. based on your after-tax annual income and annual spending:

This grid tells a simple tale: The larger the gap between your income and your spending, the sooner you will achieve financial independence.

So, focus on your savings rate. The higher this metric, the sooner you can achieve financial freedom.

Related: Visualizing Financial Independence With Tiny Blocks

9. Be patient.

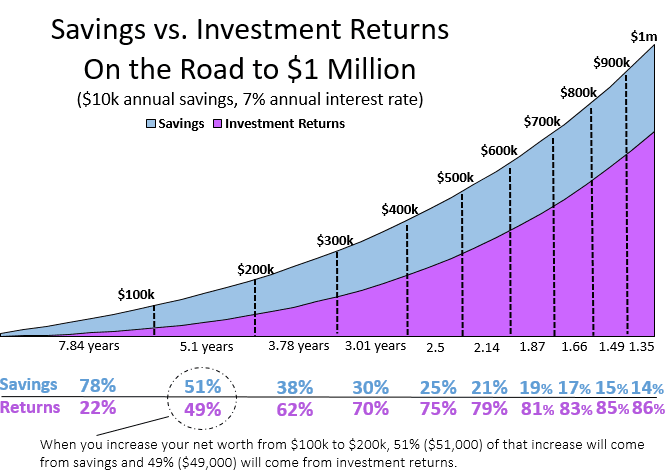

Lastly, be patient. In the early stages, most of your wealth accumulation will come purely from the difference between your income and your expenses.

As time goes on and you begin to invest more and more savings, investment returns begin to help you. This chart illustrates that point:

If you were to invest $10,000 per year and earn 7% annual returns, it would take you 7.84 years to accumulate $100k. If you continued to save $10,000 per year earning the same returns, the next $100k would only take 5.1 years to reach. This is due to the fact that investment returns begin to account for more net worth growth over time.

Related:

Visualizing the Impact of Contributions vs. Investment Returns

Patient People Are Outliers and Their Advantage is Insane

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.