4 min read

If you had invested just $1,000 in Amazon’s IPO in 1997, your initial investment would be worth nearly $800,000 today.

This is a stat that people love to use when talking about unicorn long-term stocks like Amazon, Apple, Berkshire Hathaway. etc.

“If you had just invested [some small amount] in [some wildly successful individual stock] in [some time 10-20 years ago, it would be worth [some large amount] today…”

Talking in this manner makes it seem like investing in individual stocks is not only a fantastic idea, but a fairly simple way to earn stellar returns.

But the truth is that home run stocks are only home runs in hindsight. And most people who did invest in these stocks in the early years didn’t actually hang on to their investments for several decades because they either sold out of excitement when the stock price doubled or sold out of fear when the stock price halved.

And for every Amazon, there are a dozen other publicly traded stocks that have performed miserably over the long term or have even gone to zero. This is why, for the average investor, it often makes more sense to invest in index funds – funds that holds hundreds or even thousands of individual stocks – as opposed to individual stocks.

In one of my favorite investment books, The Bogleheads’ Guide to the Three Fund Portfolio, Taylor Larimore shares several advantages that index funds offer compared to individual stocks:

1. No individual stock risk.

“Unlike mutual funds, individual stocks can plunge to zero. On the 50th birthday of the S&P 500 Index, only 86 of the original 500 companies still remained, showing it is possible to turn a large fortune into a small fortune with individual stocks. On the other hand, it is unheard of for a registered mutual fund to go to zero.”

2. Above-average return.

“The probability that a basket of ten active funds will outperform an all-index fund over a 25-year period is only 1%.”

3. Low costs.

“To give you an idea of the impact of costs, consider this: If stocks gain an average of 6% annually during the next 30 years, someone who invested $25,000 with a 1% yearly fee will forego more than $35,000 in gains because of the fee – more than the original investment!”

4. Maximum diversification (lower risk).

Some individual stocks go bankrupt, but an index fund that holds hundreds or thousands of individual stocks is largely unaffected by individual stock bankruptcies.

Larimore concludes the book by saying that investors can obtain both diversification and satisfactory investment returns by investing in just three index funds:

- A total U.S. stock market index fund

- A total U.S. bond market index fund

- A total international stock market index fund

Based on your risk tolerance, you can adjust the composition of your portfolio (e.g. more conservative investors may wish to have a higher percentage of bonds).

And while the three-fund portfolio is a popular approach for many investors, it’s possible to add one more asset class in the mix to increase diversification even further, thus creating a four fund portfolio.

How to Create a Four Fund Portfolio

Assuming you have a three-fund portfolio composed of a total U.S. stock market fund, a total U.S. bond market fund, and a total international stock market fund, there are two different funds that you could add to your portfolio to create a four fund portfolio:

- A total international bond index fund

- A total U.S. REIT index fund

Adding an international bond index fund

One example of a brokerage firm that advocates for throwing an international bond fund into the mix is Vanguard. The Vanguard LifeStrategy Funds – funds that offer low fees, broad diversification, and automatic rebalancing – are designed to be one-stop funds that investors can use as their entire investment portfolio.

These portfolios are composed of the following funds:

- A total U.S. stock market index fund

- A total U.S. bond index fund

- A total international stock market index fund

- A total international bond index fund

Vanguard offers the following four variations of these funds, ranging from conservative to aggressive:

| Income Fund | Conservative Growth Fund | Moderate Growth Fund | Growth Fund | |

|---|---|---|---|---|

| Vanguard Total Bond Market Fund | 56% | 42% | 28% | 14% |

| Vanguard Total International Bond Market Fund | 24% | 18% | 12% | 6% |

| Vanguard Total U.S. Stock Market Fund | 12% | 24% | 36% | 48% |

| Vanguard Total International Stock Market Fund | 8% | 16% | 24% | 32% |

The income fund holds 80% bonds and 20% stocks, which is designed for investors who would like to be more conservative and place a priority on income, rather than growth.

Conversely, the growth fund holds 80% stocks and 20% bonds, which is designed for investors who would like to be more aggressive and place a priority on growth, rather than income.

It’s possible to invest in each of these four funds individually, or to simply invest in the Vanguard LifeStrategy fund, which offers the benefit of automatic rebalancing although it has a slightly higher expense ratio (0.11%) compared to buying and holding the individual funds.

Adding a total U.S. REIT index fund

For investors who would like to create a four fund portfolio by adding real estate into their portfolio via REITs (real estate investment trusts), they can follow the approach of investor Rick Ferri, who proposes a portfolio composed of the following funds:

- A total U.S. stock market index fund

- A total U.S. bond index fund

- A total international stock market index fund

- A total U.S. REIT index fund

The rationale for adding U.S. REITs into the mix is the simple fact that they offer further portfolio diversification and are only mildly correlated with U.S. stocks.

In fact, I wrote an entire post that examined the correlation between U.S. REITs and U.S. stocks and shared the following findings:

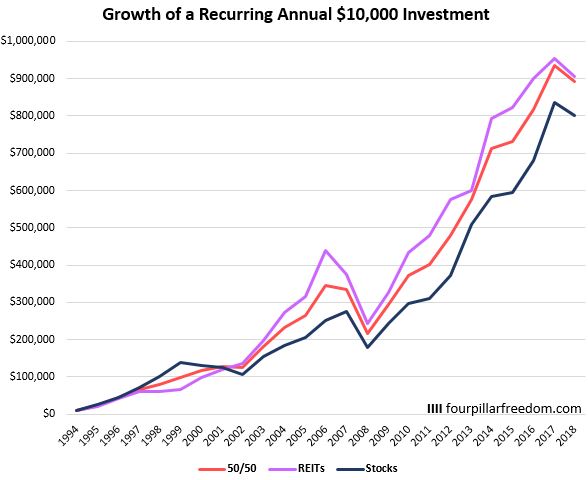

From 1994 through 2018, U.S. stocks delivered 8.94% annual returns with a standard deviation of 18.00% while REITs delivered 8.87% annual returns with a standard deviation of 18.72%. The correlation between these two asset classes was 0.45.

Although stocks and REITs delivered nearly identical returns, owning both asset classes would have offered a smoother overall ride since they were only mildly correlated. To illustrate this, check out the following graph that shows the growth of a $10,000 investment into three different portfolios each year from 1994 through 2018:

The 50/50 stock/REIT portfolio was much less volatile during this time frame than the all-REIT or all-stock portfolio. This is one potential benefit of adding REITs into a portfolio: They have the potential to reduce overall volatility without reducing overall returns.

To actually create this four fund portfolio, Rick Ferri proposes that investors first determine their bond allocation. With the remaining funds, allocate 60% to US stock, 30% to international and 10% to REITs.

For example, suppose you want 20% of your total portfolio to be in bonds. Thus, with the remaining 80% of your portfolio, it would be allocated to 48% U.S. stocks, 24% international stocks, and 8% REITs.

How to Create a Four Fund Portfolio with Vanguard

A Four Fund Portfolio can easily be constructed on any major brokerage platform like Schwab, Fidelity, Vanguard, etc. but for the sake of simplicity here are the ETFs you would need to invest in to create a four fund portfolio through Vanguard:

A Four Fund Portfolio with International Stocks:

| Fund | Ticker | Expense Ratio |

|---|---|---|

| Vanguard Total Stock Market ETF | VTI | .03% |

| Vanguard Total International Stock ETF | VXUS | .09% |

| Vanguard Total Bond Market ETF | BND | .035% |

| Vanguard Total International Bond Market ETF | BNDX | .09% |

A Four Fund Portfolio with U.S. REITs:

| Fund | Ticker | Expense Ratio |

|---|---|---|

| Vanguard Total Stock Market ETF | VTI | .03% |

| Vanguard Total International Stock ETF | VXUS | .09% |

| Vanguard Total Bond Market ETF | BND | .035% |

| Vanguard Total REIT ETF | VNQ | .12% |

Further Reading:

Should You Invest Internationally?

Are REITs and Stocks Correlated?

Build Wealth with Lazy Portfolios

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.