7 min read

Books, blogs, videos, and podcasts can all be great places to learn about personal finance, but there’s one place I’ve found that delivers the most actionable information in the least amount of words: Reddit.

Reddit is a platform where members submit content like links, text posts, videos, and images, which are then voted up or down by other members. Within Reddit, there are subreddits where people discuss specific topics. A few of my favorite subreddits revolve around personal finance, financial planning, and frugality.

The reason Reddit is such a great resource is because it allows people to be anonymous, which means they’re more open to sharing personal stories and real financial numbers. Also, since members can vote certain posts up or down, the most useful and actionable posts and comments naturally rise to the top.

Reddit is such a helpful place that I often append “Reddit” to the end of my google searches. For example, instead of searching:

“Buy vs. lease a car”

I’ll instead search:

“Buy vs. lease a car reddit”

One of my favorite solopreneurs that I follow on Twitter, Pieter Levels, once tweeted that he does the same:

Here are 10 of my favorite personal finance lessons that I’ve learned on Reddit over the years.

1. “My Dad just figured out he’s been paying $30/month for AOL dial-up internet he hasn’t used for at least the last ten years.”

The bill was being autopaid on his credit card. I think he was aware he was paying it (I’m assuming), but not sure that he really knew why. Or he forgot about it as I don’t believe he receives physical bills in the mail and he autopays everything through his card.

He’s actually super smart financially. Budgets his money, is on track to retire next year (he’s 56 now), uses a credit card for all his spending for points, and owns approximately 14 rental properties.

Even for financially savvy people who keep a close eye on their credit card statements, it’s possible to overlook recurring bills for services that you don’t even use. This is why it’s important to check your statements each month. Paying $30 each month for something like AOL dial-up internet for several years in a row can really add up.

Fortunately, free apps like Trim exist so that you don’t have to manually look through your credit card statements for recurring bills you’re paying. Instead, you can download Trim which will automatically identify all of your monthly recurring bills, provide you with a summary of how much you’re paying, and offer to cancel or negotiate a lower price for each service.

2. “Stop freaking out about the next recession.”

In this post, one Reddit user shares a few helpful tips for how to handle the next recession, whenever that may come:

1. The news media tries to constantly stir up fear about the next recession because it draws viewers in, which is good for them financially. Your best bet is to largely ignore the news.

2. One of the best ways to prepare for the next recession is to simply live within your means. Don’t overspend on things you don’t need and build up a savings buffer that you can fall back on if it comes to that.

3. Do not sell your stocks when the recession hits. Instead, this would actually be the time to buy more stocks since they would be on sale.

Here are a few articles I’ve written about recessions that echo similar advice:

Here’s How Long the Stock Market has Historically Taken to Recover from Drops

If You Have a Long Investing Horizon, You Should Hope for Market Drops

How to Think About Market Drops

3. “Quick Reminder to Not Give Away Your Salary Requirement in a Job Interview”

I know I’ve read this here before but had a real-life experience with it yesterday that I thought I’d share.

Going into the interview I was hoping/expecting that the range for the salary would be similar to where I am now. When the company recruiter asked me what my target salary was, I responded by asking, “What is the range for the position?” to which they responded with their target, which was $30k more than I was expecting/am making now. Essentially, if I would have given the range I was hoping for (even if it was +$10k more than I am making it now) I still would have sold myself short.

This lesson is applicable to basically everyone. At one point or another, most people will have to go through a job interview process and an important part of that process is negotiating salary.

One of the biggest mistakes you can make when negotiating is throwing out your salary number before the HR department throws out their number. Instead, by asking them what their “range” is for the particular position you’re interviewing for, you reduce the chances that you throw out a number that is below their range.

My friend The Luxe Strategist echoed this advice in an article titled Negotiate Your Salary, Please: You Owe It To Yourself:

“If you tell the HR person your current salary, guess what? You’re on your way to getting underpaid again. Now they know they can just tack on a few extra thousand dollars to your current salary to make it just appealing enough to jump ship.”

This simple tip – to not give your expected salary – can help you earn thousands of dollars more per year.

4. “Please, for the sake of your wallet, meal prep.”

I’m slowly but surely crawling my way out of that lovely college student debt I incurred over four years and gaining financial independence. I’ve found out how insanely important meal prepping can be.

Every Sunday, for about 2 hours, I cook and cook and cook. I make sure I make enough for my fiancé and I to have lunches for the entire week. That’s all it takes, two hours! And like $40 in groceries. When I was really struggling for money, I would still find myself going out to lunch every single day and spending $10-$15 a meal. That’s $50-$75 a week! Now I cook for two people for less than that.

Just a little advice and personal success here – meal prep your heart out and your wallet will thank you.

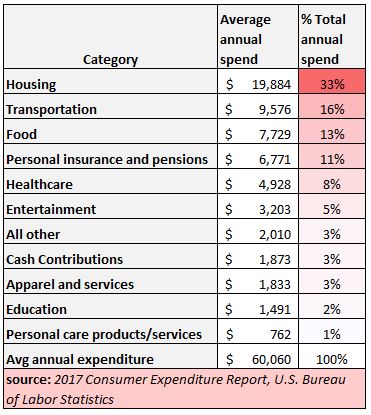

For most Americans, the “big three” expenses are housing, transportation, and food. Here’s the spending breakdown for the average U.S. household based on the 2017 Consumer Expenditure Report:

One of the easiest ways to reduce spending on the third biggest expense of food is to simply meal prep on Sundays for the week ahead. By doing this, you can easily save $50 or more per week by eliminating the need to buy lunch somewhere.

If you and your significant other both meal prep, you can save $100 or more per week as a couple. That’s an extra $5,200 per year, just from a simple Sunday habit.

5. “Save Until it Hurts, Then Back Off!”

One Reddit user shares how much his life improved by reducing his savings rate from 65% to 55%.

I’m currently shooting for a 55% savings rate and I cannot tell you how much more I enjoy life. I went from feeling like I couldn’t spend a dollar that wasn’t strictly budgeted, to travelling with friends, going to concerts, and enjoying the pleasures of life. That 10% made all the difference in the world, so I urge you wonderful people to not deprive yourselves too much of the life you want and risk burnout.

Plan for the future, sure, but realize that nothing is guaranteed. Strive to balance the wants and needs of the future with the wants and needs of now.

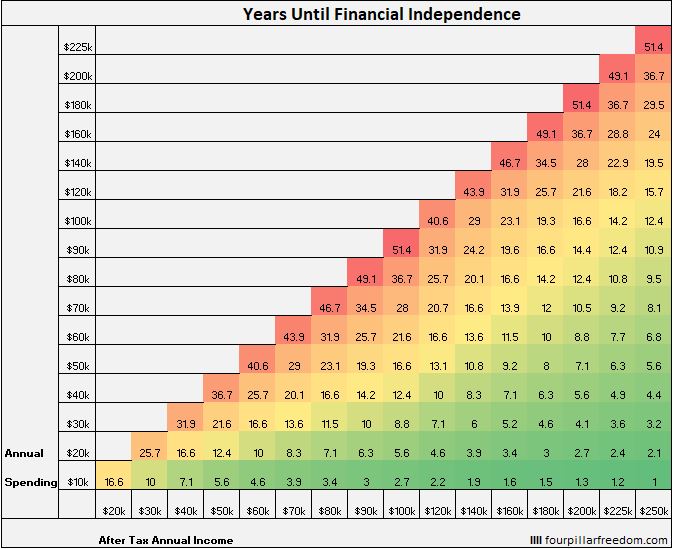

The math doesn’t lie: The higher your savings rate, the faster you will achieve financial independence. Look no further than the financial independence grid as evidence:

However, this particular Reddit user and others around the personal finance community are starting to realizing something: Perhaps you should prioritize how enjoyable your journey to financial independence is rather than prioritizing how fast you can get there.

A higher savings rate might force you to skip out on things like travel, experiences, and social events. And while this would allow you to reach F.I. faster, it would make your journey less enjoyable. There’s a fine line between being stingy and being frugal with your money.

For many people, reducing their savings rate by just a little would allow them to enjoy the journey to financial independence much more.

6. “I asked Discover Card to lower my APR, just to see if they would, and they gave me 0% for 12 months. Doesn’t hurt to ask.”

A short post with an actionable message: Call your service providers (credit card, internet, phone, cable, etc.) and ask for them to lower your monthly rate. In the best-case scenario, they will lower your rate. In the worst-case scenario, they’ll say “no” and you’ll pay the same amount you’re already paying. There’s basically no downside to asking.

You can also ask for lower rates on big-ticket items as well. As Mr. Money Mustache explained in this article, making a few phone calls to negotiate your car insurance, mortgage, and other large bills can save you literally thousands of dollars with only a few minutes of work.

7. “Reminder: Khan Academy still has basic explanations on taxes in the U.S.”

Taxes can be confusing even for the biggest finance nerds. Luckily, Khan Academy has several useful videos that explain the basics of the U.S. tax system in an easy-to-understand manner.

Khan Academy also has tons of helpful videos on personal finance that explain the basics of stocks and bonds, renting vs. buying, debt, inflation, and much more. I frequently recommend these videos to friends who are just dipping their toes into personal finance.

8. “Why I sleep like a baby since I adopted minimalism”

Like most people, I used to be concerned with status symbols…

I then realized, how silly it is to spend 10 hours a day working, so my neighbour can envy my car. God damn pathetic. I used that car a total of 10 minutes a day. 5 Minutes to work and 5 minutes back. Germany is a small country. Texas alone is 5 times as big. Distances are tiny. I belong to the group of people who dont really need a car but like to have one.

So I sold my car and something magical happened. I stopped spending money on gas, repairs, taxes, insurance, winter tires, summer tires etc. A few months later I checked my account and couldnt really believe how much money I had saved up.

I then asked myself how much money I’d save if I didnt buy a new smartphone every year and casually became more and more minimalistic every day. If something breaks, I fix it instead of spending money on new stuff (including my 7 year old Samsung Galaxy S3 and my laptop).

The one thing money buys without spending it is peace of mind. In my opinion there is not a car in the world, that can compete with that. When I go to bed, I close my eyes and I am gone. Far fewer worrying thoughts and money problems. It’s amazing.

Minimalism offers the obvious benefit of lower spending but it also offers the benefit of peace of mind, which is what we’re all after anyway. Conquering your finances is less about accumulating an impressive bank balance and more about achieving peace of mind. It’s about obtaining freedom from financial anxiety and stress. Fortunately, minimalism offers a natural way to do so.

9. “How to prioritize spending your money – a flowchart”

In this post, one Reddit user provides a couple flowcharts that illustrate the order in which you should spend your money. One flowchart is incredibly simple, but useful:

The other flowchart is much more detailed and offers an in-depth strategy for spending money:

A zoomable version of this chart can be found here.

Both of these charts are helpful for anyone who wants a guide for how they should spend their money.

Learning About Personal Finance via Reddit

Keep in mind that most advice you’ll find on various subreddits come from people sharing their own stories, opinions, and experiences.

With that said, I’ve found Reddit to be an incredibly helpful place to pick up personal finance tips and tricks that I otherwise would not have found.

If you’re looking for a good place to start on Reddit, I recommend checking out the subreddit titled Personal Finance. It’s home to over 14 million members and is a great place to find lively discussions around all things money.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.